Digitization can now be found everywhere and is spreading like wildfire.

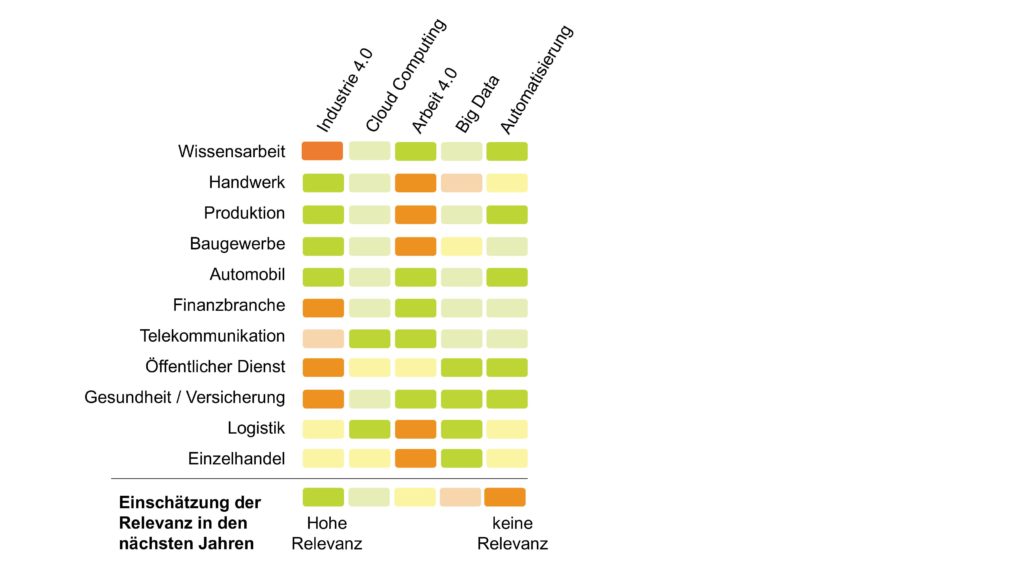

I am therefore now writing a whole series of articles on the subject of digitization. My motivation behind this is that digitization means something different for every industry and type of company and I want to work out these differences. An illustration of the differences in different industries can be found in the following figure.

In this section I would like to go into the actual core of this article and illustrate digitization in the financial sector.

Industry characteristics

The core task of companies in the financial sector, such as banks, has always been the management of money. However, banks will have to renounce this in the future, because thanks to digitization, key functions, such as the issuing of money, are already being taken over by other agencies such as supermarkets. The financial sector is therefore increasingly exposed to pressure to move towards Work 4.0. The previously neglected introduction of agile methods is now becoming more and more important. The lean processes brought about by agility and the automation of daily business tasks are intended to save personnel and counteract the pressure of low interest rates. This means that digitization measures are now vital for financial institutions.

The current digitization in the financial sector

While many companies in the financial sector have already completely automated essential core tasks in day-to-day business, customers have so far not felt the effects of digitization in financial institutions. Technological innovations are only slowly promoted and implemented by service providers such as banks. Instead, technology providers and fintechs are pointing the way to the future in the area of private customer business.

In order to counteract the loss of important customers, banks are therefore increasingly relying on cooperations with fintechs in order to be able to take advantage of their advancement of digital developments, e.g. to expand their offerings.

Advantages of digitization in the financial sector

Customers are now demanding the technological use of bank-related applications as a prerequisite for good service. Functions such as online banking have long since become part of everyday life. Customers also increasingly want the link between offline and online banking and financial institutions are forced to react to precisely these wishes with a comprehensive range of services.

The linking of the previously separate sales channels and the consolidation of these into a holistic concept as well as the modernization of internal processes and structures offer enormous efficiency and earnings potential for the financial sector.

Tip:

If you are as excited about this topic as I am, then you can find the entire article series here !

Image source: pixabay.com

[fotolia]